Better Late than Never: Getting Serious about Retirement Planning after 50

You’ve spent the last two decades focusing on your career, your family, getting your kids ready or through college, and then it hits you all at once…you are 50 and have no retirement plan. It is more common than you would think for our practice to meet new clients at this critical time. Too often we meet families that have selflessly devoted all their resources to the people around them, all the while, ignoring their own future. But now you are turning a corner and are ready to focus on yourself. The following are a few tips to consider when starting to plan for your retirement in your 50s.

1. TAKE INVENTORY

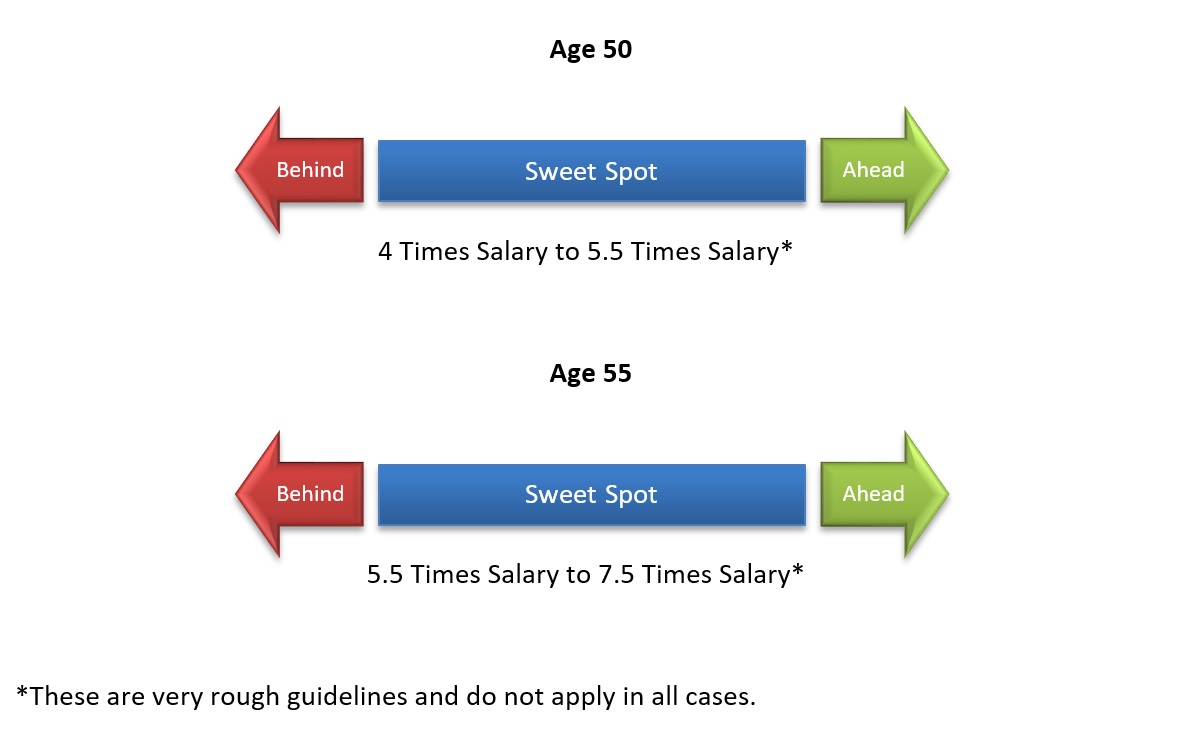

Take some time to gather your financial information. Make a list of all your assets such as 401(k), IRA, stocks, banks accounts, cash value life insurance, pension, etc. You should list the value, the owner, any beneficiaries, how much you contribute, and how much your employer contributes if applicable. While you are at it, this is a good time to review your will. Add together the list of those assets (excluding your primary home) and use the following scale to see if you are ahead or behind.

2. GET A PARTNER

There is no more time to waste and you cannot afford to drop the ball again. Hiring a professional, like one of the advisors at our practice, will not only help you formulate a plan but keep you accountable to it. When looking for a partner to help you up to and through retirement we recommend looking for the following traits.

- Make sure they start with a plan. If all you are hearing are investment ideas then you are working with a salesman, not an advisor

- Look for independent advice. Are the recommendations you will receive best for you or best for the person giving the advice?

- Look for credentials and/or experience. A Certified Financial Planner™ has studied extensively in the art of creating a financial plan and they are held to a higher standard by the CFP® Board.

- Ask about their philosophy about funding your retirement. For example, our practice follows the adage: “The true definition of wealth is when your income exceeds your expenses.” So, our plans emphasize on day to day income needs being met in retirement and do not depend on growth alone.

3. MUSTER OUT SOME “CATCH UP”

Hopefully you should start to see some of your expenses dropping off at this point and/or your income going up as you reach the latter part of your career. Either way it is time to start socking away money for your future. Since you do not have as much time as a 20-something, compounding will not work as much in your favor so you need to compensate by saving more. The good news is that the government allows you to start utilizing what they call “catch up” contributions. If you own an IRA in 2017, this means you can add an extra $1,000 per year on top of the $5,500 you can already contribute for a total of $6,500. If you participate in a 401(k), you can do $6,000 above the $18,000 you were previously allowed for a total of $24,000.

4. SET A GOAL

Think about your last vacation. Did you spend time thinking about where you wanted to go? Did you take the time to find the best flight, best hotel, where you were going to eat? Or did you just show up to the airport and get on a random flight? Your retirement should be the biggest vacation of your life. Spend the time planning to make it great. We recommend setting a monthly spending goal such as, I would like to spend $10,000 a month in retirement. Then work backwards to see how you will achieve that. For example, $3000 per month from Social Security and $7000 per month from other assets. Advisors like us a SJK Wealth Management can help you figure these numbers out and then put a plan in place to work towards achieving those income goals.

5. DON’T IGNORE THE VERY LONG TERM

You are also approaching the age where it makes sense to consider funding long-term care insurance. This type of insurance is usually called “nursing home” insurance, but we find that this type of insurance keeps our clients out of nursing homes. That is because they can then afford assistance in their own home before needing around the clock care of a nursing home. For pennies on the dollar today, you can begin to set aside funds to take care of your much older self. If you have had a loved one need nursing care, you know how expensive it is and how stressful not having the funds to pay for it set aside can be. We recommend our clients carry this type of coverage and to pay for it while they are still in their active income years. Some types of coverage allow you to finish paying premium by age 65 or over a 10-year period.

The bottom line is that it is not too late to still achieve your financial goals. It is okay to be a little bit selfish now and do something for your future. What are you waiting for, get started now!